CD Projekt Red Stock: How Witcher 4 Announcement Impacts Share Price

CD Projekt Red’s stock analysis reveals the potential impact of the Witcher 4 announcement on its share price, examining investor confidence, project timelines, and market trends.

The announcement of Witcher 4 has sent ripples through the gaming community and the stock market. This article delves into a CD Projekt Red stock analysis: Impact of Witcher 4 announcement on share price, exploring how this highly anticipated release could affect the company’s financial future, so let’s delve into the interplay between game development and stock performance.

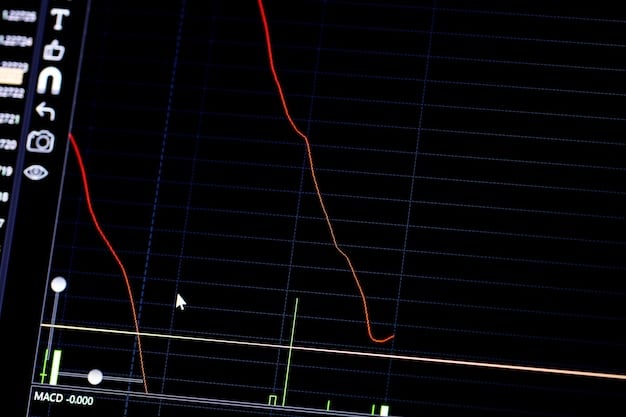

cd projekt red stock performance: before the announcement

Before the electrifying announcement of “The Witcher 4,” CD Projekt Red’s stock performance was a narrative of resilience and measured growth, navigating the complexities inherent in the gaming industry. From navigating the challenges of game development to sustaining investor confidence, the company’s stock activity reflected a mix of expectations and real-world milestones.

The stock price leading up to the big reveal had its own story to tell. A careful look at CD Projekt Red’s stock charts from the months before shows a landscape marked by cautious optimism, but it was far from a smooth ride. Periodic surges of investor enthusiasm were often met with cool-headed corrections, highlighting the market’s sensitivity to both the promises and the uncertainties of the gaming world.

Key Factors Influencing Pre-Announcement Stock

Several key factors played a significant role in shaping CD Projekt Red’s stock performance prior to the announcement. Let’s break down the nuances that contributed to the stock’s behavior.

- Earnings Reports: Quarterly and annual earnings reports provided a snapshot of the company’s financial health, influencing investor sentiment and stock valuations.

- Game Updates: Updates, patches, and DLC releases for existing games, like “Cyberpunk 2077,” had a direct impact on player engagement and, consequently, the stock price.

- Industry Conferences: Appearances at industry events and conferences offered opportunities to showcase upcoming projects and initiatives, shaping market perceptions and investor expectations.

- Overall Market Trends: Broader market trends and economic conditions also contributed to CD Projekt Red’s stock performance, mirroring the fluctuations of the global economy.

The stock performance of CD Projekt Red before the announcement was shaped by a complex interplay of internal developments and external factors. Understanding these dynamics sets the stage for analyzing the seismic shift triggered by the announcement of “The Witcher 4.”

initial market reaction to the witcher 4 announcement

The moment CD Projekt Red officially announced “The Witcher 4,” it was as if an electric current surged through the stock market. The initial reaction was swift and decisive, characterized by a noticeable spike in trading volume and a rapid appreciation in share prices. The announcement served as a catalyst, injecting renewed optimism into the company’s prospects.

It was a reaction fueled by more than just hype. The market responded to the potential of “The Witcher 4” to rejuvenate CD Projekt Red’s financial outlook. It represented a significant boost to investor confidence as well. As trading volume surged, it became apparent that the announcement resonated deeply with both retail investors and institutional players.

Factors Driving the Positive Surge

The positive surge in CD Projekt Red’s stock following the “Witcher 4” announcement can be attributed to a combination of factors.

- Investor Confidence: The announcement signaled a renewed commitment to CD Projekt Red’s flagship franchise, fostering confidence among investors in the company’s long-term growth potential.

- Ecosystem of Success: “The Witcher” IP enjoys widespread recognition and critical acclaim, ensuring a built-in audience for future installments.

- Studio Track Record: CD Projekt Red’s reputation for crafting immersive, narrative-driven experiences contributes to the belief that “The Witcher 4” will meet or exceed expectations.

- Anticipated Revenue Streams: Investors anticipate substantial revenue streams from the game’s launch, DLC releases, and associated merchandise, bolstering their optimism for CD Projekt Red’s financial prospects.

The announcement of “The Witcher 4” triggered an instantaneous and overwhelmingly positive response in the stock market. It underscored the power of a well-regarded franchise to reignite investor enthusiasm and shape perceptions.

analyzing long-term stock potential after the announcement

As the initial euphoria surrounding the “Witcher 4” announcement begins to subside, the focus shifts toward assessing the long-term stock potential of CD Projekt Red and projecting the likely trajectory of the company’s shares in the coming months and years. This entails a more nuanced evaluation that considers market dynamics.

Assessing the potential of a stock like CD Projekt Red goes beyond surface-level enthusiasm. It demands a detailed analysis that accounts for the multiple layers of market dynamics, studio capabilities, and consumer expectations that shape future performance. The long-term stock perspective is about understanding the company’s ability to convert promise into practice, hype into tangible financial growth.

Key Considerations for Long-Term Stock Analysis

The long-term trajectory lies in many things. Here are some things to consider.

- Development Timeline: The anticipated development timeline for “The Witcher 4” is a critical factor. A realistic timeline that balances ambition with feasibility will instill confidence in investors.

- Market Competition: The competitive landscape of the gaming industry presents both challenges and opportunities. CD Projekt Red must navigate fierce competition from established players and emerging studios.

- Technical Execution: The ultimate success of “The Witcher 4” will hinge on its technical execution. A polished and bug-free release is essential for maintaining player satisfaction and fostering positive word-of-mouth.

- Monetization: CD Projekt Red’s approach to monetization will impact revenue streams and investor sentiment. A balanced strategy that respects player autonomy while maximizing profitability is paramount.

The long-term stock potential of CD Projekt Red after the “Witcher 4” announcement hinges on navigating a complex web of factors. Project timelines, market dynamics, and execution all stand as fundamental pillars supporting the company’s long-term prospects.

investor confidence and risk assessment

Investor confidence serves as the cornerstone upon which stock valuations are built. Analyzing the prevailing sentiment among investors toward CD Projekt Red is essential for understanding the company’s current stock performance and its future prospects. Assessing risk is about recognizing these potential pitfalls and considering their impact on the company’s stock.

While the announcement of “The Witcher 4” undoubtedly bolstered investor confidence, it is important to evaluate the depth and resilience of this renewed optimism. Investor confidence is not a monolithic entity; it is an aggregate of individual and institutional beliefs.

Factors Influencing Investor Sentiment

Here are some factors that play a role in sentiment of the CD Projekt Red stock

- Company Communication: Clear, transparent, and consistent communication from CD Projekt Red can reinforce investor confidence. Conversely, vague or misleading statements can erode trust.

- Industry Trends: Broader trends in the gaming industry, such as the rise of subscription services or the evolving preferences of gamers, can impact investor sentiment toward CD Projekt Red.

- Critical Reception: Critical acclaim for CD Projekt Red’s games, including “The Witcher 4” will have repercussions on investor valuation of the stock.

CD Projekt Red’s stock performance depends not only on the quality of its games but also on its ability to navigate the currents of market sentiment and mitigate risks. Transparency, adaptability, and a keen awareness of both internal and external factors are crucial for sustaining investor confidence and ensuring long-term prosperity.

potential challenges and mitigating strategies for cd projekt red

While the announcement of “The Witcher 4” has instilled renewed optimism in CD Projekt Red’s stock potential, it’s essential to address potential challenges that the company may encounter as it navigates the development, release, and post-launch phase of the game. Here are a couple of challenges that may arise:

The gaming industry is fraught with uncertainty, from unexpected delays to unforeseen technical glitches. CD Projekt Red must anticipate and prepare for these challenges to minimize disruption and protect its reputation.

Common Industry Challenges

Here are some common challenges that are seen within the industry.

- Development Delays: Unforeseen technical challenges, scope creep, or resource constraints can lead to delays in the development timeline, potentially impacting investor confidence and stock valuations.

- Technical Glitches: The release of a game plagued by technical glitches and bugs can severely undermine player satisfaction, damage the company’s reputation, and negatively affect stock performance.

- Market Competition: The gaming industry is intensely competitive, with new titles vying for players’ attention and disposable income. CD Projekt Red must differentiate “The Witcher 4” to stand out in the crowd.

By acknowledging these potential challenges and implementing proactive strategies to mitigate their impact, CD Projekt Red can fortify its position in the market, sustain investor confidence, and pave the way for long-term success.

expert opinions and industry analysis

To gain a comprehensive understanding of CD Projekt Red’s stock potential in light of the “Witcher 4” announcement, it’s invaluable to consider the perspectives of industry analysts and financial experts.

Expert opinions and industry analysis provide in-depth evaluations, objective assessments, and insightful predictions that offer a balanced perspective on CD Projekt Red’s current situation and future prospects. This helps to remove bias and assumptions created from hype.

Key Insights from Industry Experts

Expert opinions can either validate the actions of the company or show areas of improvements. Here are some things that may be observed from experts.

- Risk Assessment: Expert opinions often involve a thorough risk assessment, identifying potential pitfalls and challenges that CD Projekt Red may face in the development, release, and post-launch phases of “The Witcher 4”.

- Comparative Analysis: Industry experts compare CD Projekt Red’s strategies and performance against those of its competitors, providing valuable insights into the company’s strengths, weaknesses, opportunities, and threats (SWOT).

- Financial Projections: Financial analysts offer projections and forecasts for CD Projekt Red’s future revenue, earnings, and stock performance based on various scenarios and assumptions.

By combining expert opinions, industry analysis, and a thorough understanding of market dynamics, investors can make informed decisions about CD Projekt Red and its stock potential. The announcement of “The Witcher 4” has injected fresh optimism into the company’s prospects, it is a good opportunity to re-assess what is possible with the asset.

| Key Point | Brief Description |

|---|---|

| 📈 Initial Stock Surge | Stock rose quickly after Witcher 4 announcement. |

| 🕰 Long-Term Potential | Success hinges on development timelines & execution. |

| ⚠️ Risk Factors | Delays, glitches, and market competition remain. |

| 🧐 Expert Analysis | Industry experts provide balanced perspectives. |

Frequently Asked Questions

▼

The announcement led to an immediate surge in CD Projekt Red’s stock price, reflecting increased investor confidence and anticipation of future revenue streams. Trading volumes rose sharply.

▼

Key factors include the game’s development timeline, market competition, technical execution, and monetization strategy, all needing careful calibration to ensure long-term success.

▼

Development delays, technical glitches in the game, and intense market competition pose significant risks. Clear communication and strong risk management are crucial for stability.

▼

Investor confidence is vital. Transparent communication, successful game releases, and positive industry trends can bolster it. Vague statements or poor performance can erode trust.

▼

Experts provide risk assessments, comparative analyses, and financial projections to give a balanced view. Their insights help inform investment decisions and reveal potential challenges as well.

Conclusion

In conclusion, the announcement of “The Witcher 4” has undoubtedly sparked renewed interest and optimism in CD Projekt Red’s stock. The initial market reaction was overwhelmingly positive, with share prices experiencing a notable surge. While the long-term stock potential depends on meeting the right needs and expectations, for now, it remains a stock that many have their eyes on.